World Class Cancer Consultation Service

World's Class Cancer Consultation Service

Why

Pathsos?

Peace of mind to Patients

Peace of mind to Patients Medical errors get reduced

Medical errors get reduced World's best Cancer Doctors

World's best Cancer Doctors Personalized Telehealth service

Personalized Telehealth service Convenient Online Service

Convenient Online Service Accesible Globally

Accesible Globally Advanced oncology Testing on International standard

Advanced oncology Testing on International standard

Our Online Cancer Consultation Services

Comprehensive Review

To find more details about Comprehensive Review Services

Treatment Review

To find more details about Treatment Review Services

Diagnostic Review

To find more details about Diagnostic Review Services

Choose PathSOS

for Better Cancer Outcomes

Best Cancer Expert's Opinion

Highly experienced panel of

cancer specialists from world's best cancer

Best Cancer Expert's Opinion

Highly experienced panel of

cancer specialists from world's best cancer

Best Cancer Expert's Opinion

Highly experienced panel of

cancer specialists from world's best cancer

Best Cancer Expert's Opinion

Highly experienced panel of

cancer specialists from world's best cancer

PathSOS Offerings

Comprehensive Review

Our selected panel of oncology experts & cancer doctors with decades of experience from India and abroad will review your case in a comprehensive manner and provide you an experts review consultation report and recommendations which will ensure best treatment.

Online Consultation

Leading Cancer centers around the world use multidisciplinary approach to select cancer treatment. This requires specialists to have extensive training & expertise that may not be available in every hospital, especially in India & surrounding countries.

Digital Pathology

We offer diagnosis services through our digital pathology that connects you with the best experts from around the world to offer you state of the art opinion at the click of a button and help to improve the overall quality.

Our Specialties

We provide sub-specialist oncology review on all major cancers including lung cancer, breast cancer, colon cancer, women's cancer, male's cancer, brain tumors, GI cancers, blood cancer, head & neck cancers etc. In today's day & age, cancer care has become a highly specialized branch & PathSOS brings to you the best oncologist.

Advanced Interpretation

We have some of India's and international top diagnostic experts that give 100% confidence to you and your doctor about the accuracy of your diagnosis. Sometimes our experts perform and advice test that may have not been done earlier or have been misinterpreted.

Complete Diagnosis

We specialize in cancer diagnosis utilizing the most advanced procedures and technology including immunohistochemistry, slide review, genomic analysis, biopsy review, and FISH reporting.

Why is it worth getting a Cancer Consultation with PathSOS ?

Accurate Cancer Diagnosis can Impact Outcomes

"As is the pathology, so is our Medicine" words of the famous physician William Osier.At PathSOS, we shareyour concern if you or your patient has been diagnosed with cancer and we understand that correct diagnosis is the first vital step towards appropriate treatment selection & prognostication. We support our doctors and specialists with an excellent and high-quality diagnostic service so that we can together improve clinical outcomes. Our commitment is diagnostic care of your patient and a comprehensive treatment modalities.

International Quality & Associations

PathSOS is led by international experts who have extensive international experience in Australia and North America the best hospitals from India. Our quality is of International Standards and you can be assured that you are getting a trustworthy consultation. Our expert would be happy to discuss your case with you, on phone or email. Our Experts are RCPA certified and our service follows quality assurance program of RCPAQP. At PathSOS, our goal is to support and complement your efforts towards patient care.

Virtual Tumor Board and its advantage

Medical decisions are complex and require a multi disciplinary approach.We partner with oncologists, hospitals, oncosurgeon and empanel them in our experts team so that our patients can have complete confidence through a comprehensive diagnosis and treatment review. Through our Integrated Diagnostics we harness the power of the multidisciplinary convergence happening now in diagnostic, prognostic, genomic and theranostic medicine to give you and your patients most comprehensive, advanced and clinically relevant diagnostic interpretations.

Dr. Nabeel Al Shafai

FRCS (Canada)

20 years of experience

Cancer neurosurgeon

Dr. Hamza Mujagic

MD, Phd ( USA )

30 years of experience

Oncologist

"Advanced Cancer Testing"

Cancer is a complex disease, caused by a wide range of genetic mutations that can be present in many combinations. we provide advanced testing services including immunoHistoChemistry, ISH, Cytogenetics, Molecular & Genomic Testing

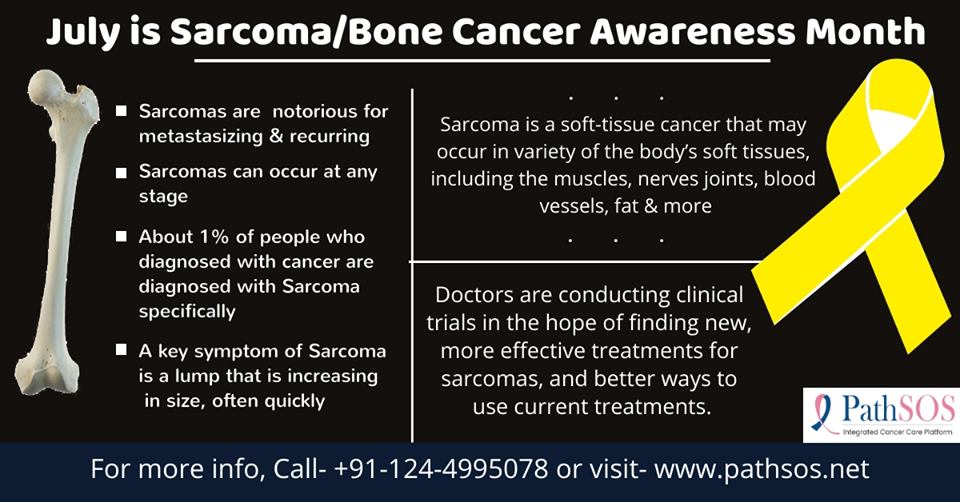

Common Cancers we can help you with..

Lung Cancer

Liver Cancer

Cervical Cancer

Stomach Cancer

Head & Neck Cancer

Lymph Cancer

Breast Cancer

Kidney Cancer

Ovarian Cancer

Prostate Cancer

PathSOS Media

"If you are a hospital, we would like to invite you to join PathSOS"

Our Partner Hospitals

"Cancer Counselling for Patients and Carers"

Cancer does not just affect your body, it also brings in emotional, social and psychological challenges for the patient as well as thrie family. Our counsellors focus specifically on the emotional and psychological impact of cancer.

- What is PATHSOS ?

- PATHSOS is a specialist cancer second opinion service specializing in diagnosis and biopsy review. Since PATHSOS is independent medical practice exclusively devoted to the care of cancer patients and we are not affiliated to any hospital, we give unbiased opinion. We bring highly trained oncologists and supportive services to local communities, so cancer patients no longer need to travel long distances to receive today's best available cancer care.

- What causes cancer?

- Cancer cells develop because of damage to DNA, a substance in every cell that directs all activity of the cell. Usually when DNA becomes faulty, the body is able to repair it; however, some times it is not repaired and the cell becomes abnormal. Scientists are working to better understand what causes DNA to become damaged. I hereditary forms of cancer, people inherit damaged DNA, which accounts for inherited cancers.

More often, though, cancer is caused by exposure to carcinogenic substances present in environmental (UV rays, pollution) or individual behaviors such as smoking. - What are the signs and symptoms of cancer?

- The signs and symptoms vary depending on the specific kind of cancer, but there are some general signs and symptoms that may indicate a need for testing. These include fatigue, a sore that does not heal, nagging cough, pain, unexplained weight loss, fever and changes on the skin. Although there could be other reasons for these signs and symptoms, anyone experiencing these should consult their physician.

PathSOS Cancer information Hub

Accurate knowledge about Cancer ensures better decisions & outcome

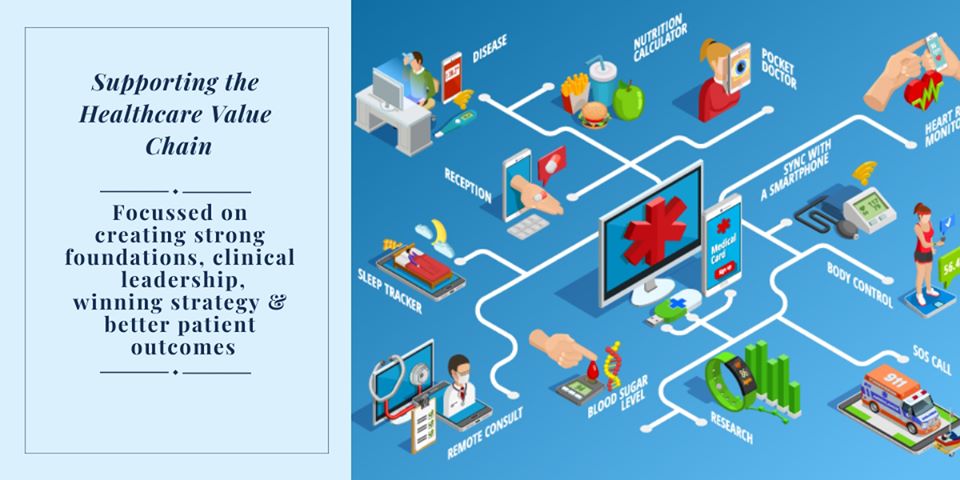

A new kind of Hospital System

Experts say “There is a mismatch between physical Hospital infrastructure and the type and volume of activities carried out.” Technology and processes must support the cost-effectiveness in the healthcare sector, as people will begin to expect more from healthcare systems. Not only are there demographic and epidemiological changes but social expectations and the shape of cities and transport systems evolve to create a new context. Previously, hospitals have been made to fulfill known demands & it had taken years to develop from scratch business plan to a concept than to an operational hospital. Now it is figured out that approximately 70 percent of the planned activities & digital technologies will be changed by their operation on the first day. “It also raises questions like how to use technology to develop cost-effective patient care? What do we do with physical buildings: Do we repurpose existing spaces or do we have to go to hub-and-spokes models?” It is evident that people expect and demand more from the Healthcare systems, no matter where they are living and the challenges faced in this are universal. The effect of the Internet on medicines from the use of remote sensing capability to cloud computing data will be immense. Patients may not have to visit hospitals for monitoring themselves. In the current transformative era, design can be disruptive – we can really rethink over it that how care is delivered. Transfer of ideas into change will be drastic rather than incremental. “The challenge for hospital designers is vast. With huge unmet needs and demand, we have to include existing infrastructure as well as the political and economic climate. Healthcare can drive the economy and become a national strategic priority as in developed countries where there is a major investment in healthcare. Also, the large pool of aging population is often better served with extra care closer to home. The virtual hospital operating through data networks using telemedicine and outreach clinics is a real possibility. In some countries, approximately 70 percent of consultations now take place over the internet. This disruptive shift will change the nature of the hospital profoundly. The system requires allegiance and brand much as social media companies now promote themselves. This future will still require physical infrastructure but more dispersed, smaller but with a strong identity. New classes of hospitals fall broadly into four categories. These are “academic medical centers” as tertiary or quaternary centers which are serving larger populations, integrated with university and technology campuses. They provide the highest level of trauma and complex care. Their requirements of big data analysis, genomic medicine and robotic surgery, etc will grow.. Emergency treatment centers are another emerging theme. Emergency departments have become increasingly ill-fitted in the slower-moving general hospitals. Stand-alone emergency center, operating theatres, and clinical decision unit with short-stay beds provides are a more effective model. One example of this is the specialist emergency care hospital at Cramlington, Northumberland, which cost £80 million – the first of its kind in the UK – and deals only with urgent and emergency cases, such as heart attacks, car crashes, industrial injuries, and falls. Secondary level care may be better provided by “local hospitals” or polyclinics that provide outpatient diagnostics, urgent and planned elective care with some short-stay beds. The emphasis would be to reduce overhead costs but provide the natural step-up for GP referral.” The last but probably the gateway to care should be the “community hospital” that can offer intermediate care for longer-term complex rehabilitation based on a lower-cost nursing model. These centers would form a hub providing an effective bridge between inpatient care and home care. Some of these options could be offered as a hub-and-spoke model, where acute care is delivered in a centralized hospital with chronic issues catered for either at a local clinic, possibly even set up in a supermarket, or in your home. Whilst there may not be any generic ideal blueprint just yet; depending on the country and financial model you are going to come up with different flavors. But surely there is a trend to change the distribution of care. That Bigger is mostly better may be challenged when analyzing the problem from a distance. Larger hospitals can support better technologies, deploy a wider range of specialisms and have a more economical operation. However, there seems to be a consensus that a hospital can become too large to be sustainable or viable. Efficiency lies in how the tiers of the health system integrate.”

Moving towards Business model Innovation in Health care delivery

In the healthcare system, the business days, as usual, are over. Around everywhere healthcare system is facing a tough time with rising costs and uneven quality despite the hard work of well-intentioned, well-trained clinicians. Health care leaders and policymakers have tried countless incremental fixes—attacking fraud, reducing errors, enforcing practice guidelines, making patients better “consumers,” implementing electronic medical records—but none have had much impact. Uncertainty and information asymmetries in health care are the basis for a supply-sided mindset in the health care industry and for a business model for hospitals and doctor’s practices; these two models have to be challenged with business model innovation. The three elements which ensure this are standardizability, separability, and patient-centeredness. As per scientific evidence, Advances and Outcomes are more predictable, standardization is more feasible. If a standardized process can also be separated from the hospital and doctor’s practice, it is more likely that innovative business models will emerge. It’s time for a fundamentally new strategy. As per scientific evidence, Advances and Outcomes are more predictable, standardization is more feasible. If a standardized process can also be separated from the hospital and doctor’s practice, it is more likely that innovative business models will emerge. As far as patient-centeredness is concerned, it has to move beyond the oversimplifying approach to satisfy the patients with amenities and interpersonal skills of staff, to include the design of structure and processes starting from patients’ needs, expectations, and preferences and care. Unfolding the standardized and separable processes from the traditional hospital system setting will lead to an increase in hospital expenditure but on the other hand, the new business models will reduce expenses. Therefore, Innovation in the Business model is an important step to guarantee the sustainability of health care systems; And, Standardizability, Separability, and Patient-Centeredness are the key elements emphasizing the six business model innovations in Healthcare system.

How Technology Can Detect Cancer In Early Stage

Diagnosing Cancer at its earliest stages usually provides the most effective probability for a cure. The days - or even weeks - spent waiting for the results of a cancer-screening test can feel like perpetuity. Especially when the early diagnosis and treatment are tied to better outcomes. Now, a new technique to analyze proteins implemented on cancer cells shows promise in rapidly detecting these cell types. Following are some technologies which can be used to detect cancer in an early stage: 1. Nano pore blockade sensor: This sensor can detect biomarkers and single molecules at much lower levels than current blood tests will, and you can get results in several minutes. Cancer biomarkers or tumor markers are substances, usually proteins that are produced by the body in response to cancer growth. The Nanopore blockade sensors work by using magnetic particles to capture biomarkers and bring them to one of many small pores drilled through a silicon membrane. If a magnetic nanoparticle has captured the biomarker, it will block the pore. By counting which pores are blocked the biomarkers can be counted, one molecule at a time. Importantly, this device can be used on the whole blood samples in routine taken at pathology labs. 2. Electric Field-Induced Release and Measurement (EFIRM) can detect EGFR mutations directly from body fluids of lung cancer patients. It can detect 2 epidermal growth factor receptor (EGFR) mutations associated with lung cancer in the blood of non-small-cell lung carcinoma (NSCLC) patients with early-stage disease. NSCLC is usually injurious because most cases are not diagnosed until they are so advanced that surgical intervention is no longer possible. This new technology tests blood or saliva of early-stage lung cancer patients to identify 2 cancer-linked mutations published in The Journal of Molecular Diagnostics. 3. Oncology Imaging and Diagnosis: Imaging forms a necessary part of cancer clinical protocols and is able to furnish morphological, structural, metabolic and functional information. It is used to screen and diagnose cancer, guide cancer treatments, determine the effectiveness of cancer therapy and monitor cancer recurrence. Integration of oncology medical imaging with other clinical tools, such as in vitro tissue analysis, biomarker tests, and cancer screening, improves decision making. Early detection through screening based on imaging is the major contributor to a reduction in the number of deaths caused by certain types of cancers. 4. 3-D-nanopatterned microfluidic chip: The device, which is called a "3-D-nanopatterned microfluidic chip," could successfully detect cancer markers in the tiniest drop of blood or in a component of the blood called plasma. The scientists used the device for the detection, in 2 μL plasma samples from 20 ovarian cancer patients and 10 age-matched controls, of exosomes subpopulations expressing CD24, epithelial cell adhesion molecule and folate receptor alpha proteins. 5. Breathalyzer: Scientists have developed a breathalyzer to diagnose 17 diseases including cancer with one breath from a patient. The breathalyzer has an array of specially created gold nanoparticles, which are sized at billionths of a meter, and mixed with similar-sized tubes of carbon. These together create a network that is able to interact differently with each of the nearly 100 volatile compounds that each person breaths out (apart from gases like nitrogen, oxygen, and carbon dioxide).

Stats prove that Second Opinion can Impact Cancer Care

A study published in Mayo Clinic Proceedings last year also found between 45% of second opinions spurred a major change in diagnosis or treatment. Patients generally believed that second opinions are valuable and life altering decision.

Another study published in the American Journal of Medicine found that about 35% of people choose to get second opinions after they received a diagnosis in order to identify information that may have been missed or misinterpreted during the initial diagnosis.

Experts estimate that diagnostic errors happen in 10% to 15% of cases, even in the US. The figure may be higher in countries like India where quality and accreditations are not mandatory and thus causing incorrect treatment.